Digital asset developer Goldtag reached a valuation of $50 million in its Series A funding round, raising $10 million led by RePie Portföy with participation from Turkcell, Colendi, Finberg, and Inveo Portföy. Since its seed round, the company has grown tenfold and now processes over 1 million transactions each month for 2.2 million users. With the new investment, Goldtag plans to accelerate its tokenization initiatives and expand into the Middle East, targeting 5 million active users by 2026.

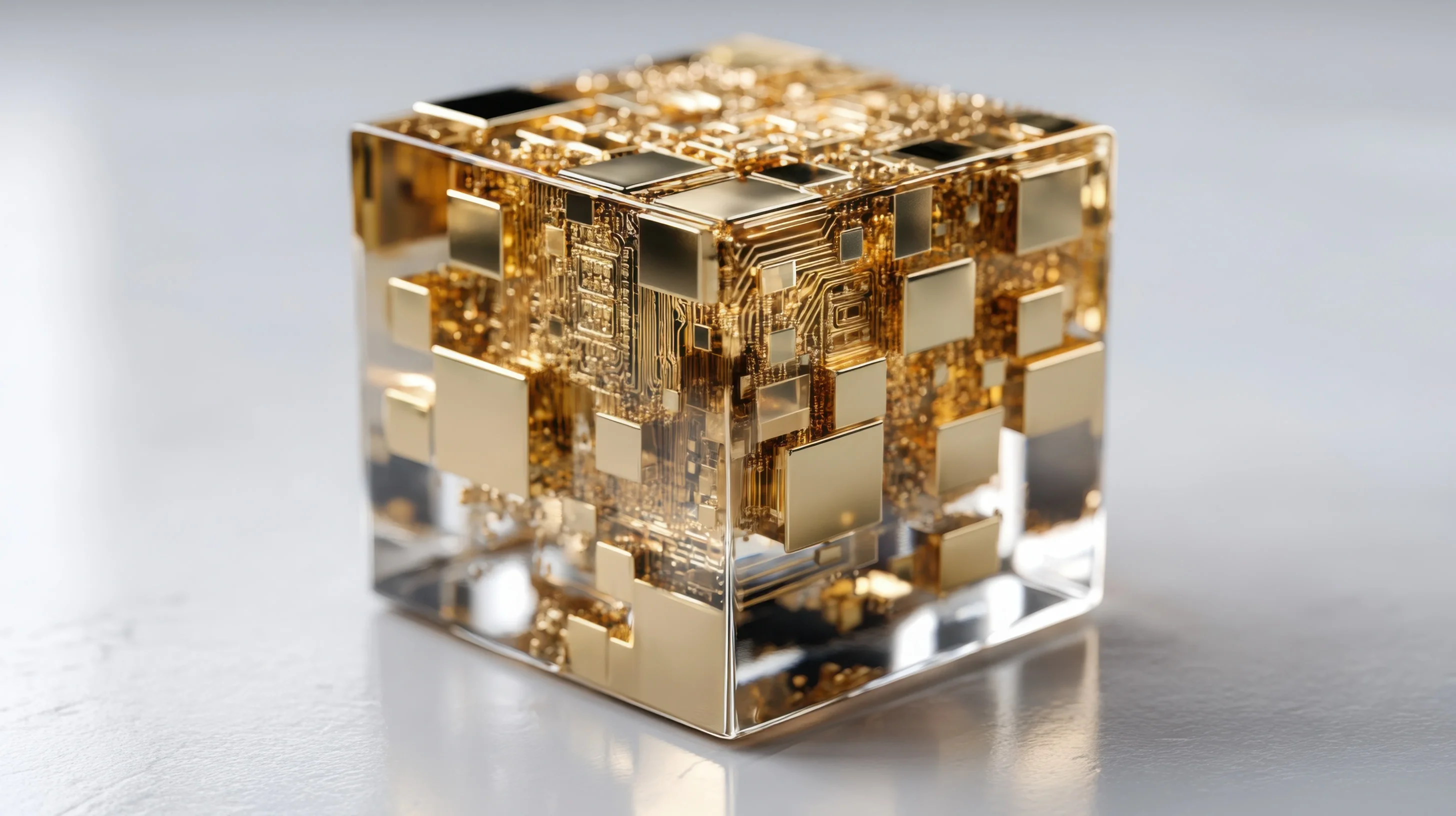

Leveraging blockchain technology, Goldtag enables the trading of precious metals such as gold, silver, and platinum, while integrating its system with multiple platforms. Today, Goldtag stands as Turkey’s largest digital precious metals platform, integrated with leading payment providers including Paycell, MoneyPay, Hepsipay, Papara, AhlPay, and PeP. Through its mobile application, users can also easily buy and sell gold, silver, and platinum.

Agricultural Commodities, Energy and Metal Products on the Way

Goldtag Co-Founder and CEO Dolunay Sabuncuoğlu stated: “We are transforming financial access into a simple, secure, and social experience. The strong interest we have received in a short period validates our product-market fit and the strength of our integration model. With this new investment, we will launch our tokenization infrastructure and scale access to alternative assets in a regulation-compliant manner. Going beyond precious metals, we aim to offer our users access to alternative investment products such as agricultural commodities (wheat, barley, corn), energy products (oil, natural gas, electricity), metals (copper, aluminum, iron), and solar power plants.”

Altuğ Dayıoğlu, General Manager of RePie Portföy — Turkey’s first and largest alternative asset management company and the lead investor in the round — said: “We continue to play a leading role in the startup ecosystem through selective investments. For RePie Portföy, deepening financial access through technology and ensuring regulatory compliance are our two core pillars. Goldtag creates real impact at the intersection of these pillars. It scales with the strength of its integrations and builds a sustainable market with its compliance standards. With this new investment, we will support its growth both in Turkey and across the Middle East.”

Secured Deals with 2 Unicorns in the Middle East

Sabuncuoğlu announced that the company is targeting an expansion into the MENA region in 2026 and has already reached agreements with two unicorn companies in the Middle Eastern market. “In addition, we are continuing integration efforts with eight companies from the banking, e-commerce, and securities sectors. Once completed, these integrations will provide access to a potential user base of 40 million people. Our goal is to exceed 5 million active users by 2026,” he stated.

Gold Investment Possible with Only 1 Lira

Goldtag’s mobile application not only enables the trading of precious metals but also allows users to create digital events such as weddings, birthdays, or traditional “gold days,” and collect valuable contributions like gold from friends. In addition to the ability to invest in gold with as little as 1 lira, Goldtag provides users with the advantage of accessing the best exchange rates even outside of regular business hours.

Users can instantly sell their gold at the current rate and transfer the Turkish lira equivalent to their bank account 24/7. If they prefer, they can also continue saving in different units, including quarter, half, full, or gram gold.

Soon: Gold and Precious Metal ATMs

Goldtag is working on a project that will allow users to physically withdraw the precious metals they own digitally, designing specialized machines for this purpose in collaboration with Turkey’s leading engineering firms.